Four strategies: The big picture

The legacy systems must finance the transformation by financing their own transformation and the work of those developing the financial innovations

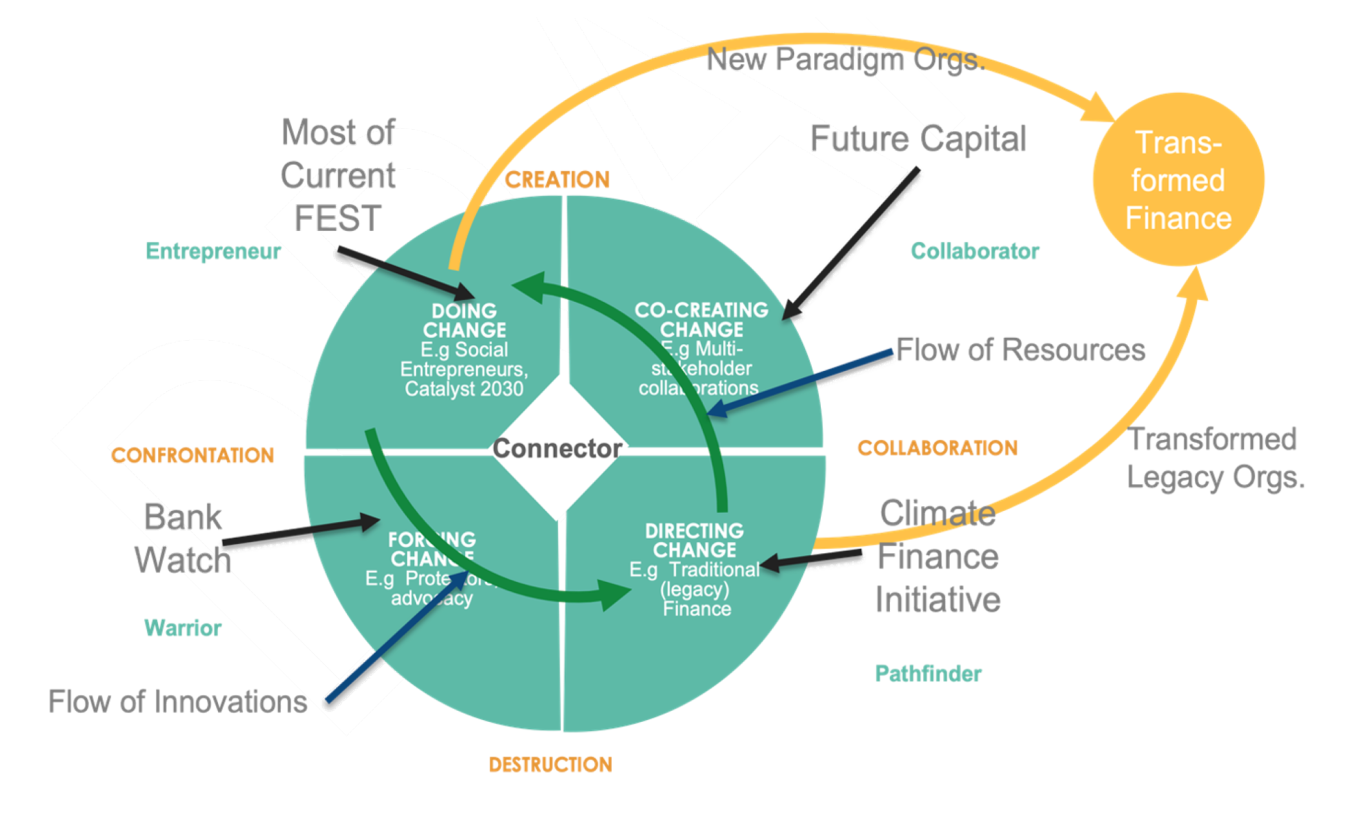

Developing the field of FST is a huge undertaking. It requires a full complement of change strategies. A 2018 article in Stanford Social Innovation Review identified four strategies present in any transformation. The figure below applies this framework to the development of the field of FST to describe the big picture strategy. The basic message is that all four strategies are necessary.

The strategies are defined in terms of two prevalent dynamics. One is the spectrum from destruction to creation. Extreme destruction might be depicted as replacement of capitalism as we know it; less extreme forms might include the evolution of a traditional financial company into an FST one. The extreme of creation is captured by the birth of a whole new financial order, while a less extreme form of creation might be the formation of a powerful FST sector.

A second dynamic is the spectrum of confrontation to collaboration. The extreme of confrontation is war over finance systems, but there are many less confrontational actions, such as those of civic protesters. At the collaboration extreme, consider the facilitation of deep mutual respect and common commitment in a group that is working together to realize a change goal through transcendence of diverse perspectives, something the Club of Rome’s Rethinking Finance Impact Hub is aiming for. The above figure aims to present these forces as the ones that will develop the needed transformed finance.

FEST arises from a community of entrepreneur doers and thinkers (Doing Change strategy). Through experiments, they are creating examples of how finance can be different. Some in the legacy finance industry realize change is needed and are trying to figure out how to support it. The legacy organizations, including foundations, investment firms, public agencies, and others must greatly increase their support for innovations and provide resources for the entrepreneurs and adopt the promising experiments themselves. This requires that legacy financial organizations become ambidextrous ones that start new entities supporting the transformation while phasing out the old parts. These, together with the successful greenfield innovations of innovative entrepreneurs, will become the new financial model.

In this process, the Warriors play a critical role for injecting energy in the system and pressure for transformation. The Collaborators create spaces to manage inter-paradigm shifts such as ones involving policy. Of course, the actual implementation is very messy and fraught with power issues.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.